|

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

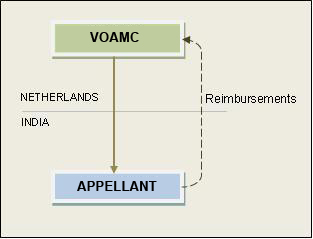

March 30, 2010 Delhi High Court Sings Out of ‘Samsung’ Tune: No Withholding in India on Payments to Non-resident The recent decision of the Karnataka High Court in Samsung Electronics Co. Ltd.,1 had caused much heartburn when it held that every person making a payment to a non-resident is under an obligation to deduct tax at source under section 195 of Income Tax Act, 1961 (“ITA”), irrespective of its taxability in India. As per that ruling, almost every payment made for the import of goods or services from foreign suppliers would be brought within the Indian tax net and subjected it to a withholding tax liability.2 The court in that case had placed heavy reliance on the decision of the Supreme Court in the Transmission Corporation Case.3 This issue was raised yet again, before the Delhi High Court (“Court”) this time, in the matter of Van Oord Acz India (P) Ltd.4 where the Court has again sought to analyze the Transmission Corporation Case (cited supra) and explicitly differed from the interpretation of the Karnataka High Court in Samsung Electronics Co. Ltd. Further, how far this decision and the decision on beneficial ownership in the case of Netherlands Holdings BV5 would have persuasive value in the case of Vodafone6 needs to be examined. Background Van Oord ACZ India (P) Ltd. (“Appellant”) is a wholly owned subsidiary of Van Oord ACZ Marine Contractors BV (“VOAMC”), a company incorporated in the Netherlands. In connection with a dredging contract, the Appellant was required to make certain reimbursement to VOAMC. The Appellant had filed an application with tax officer for issuing NIL tax withholding certificates since it was pure reimbursement of expenses and was not liable to tax in India in the hands of VOAMC. However, the tax officer held 11% of the reimbursement amount as the profit arising to VOAMC in India due to a permanent establishment and directed the Appellant to deduct tax at source. Based on the same, the Appellant deducted tax at source but only on a portion of the reimbursements. When the Appellant filed its returns, the Assessing Officer (“AO”) disallowed the deduction of the entire amount reimbursed by the Appellant to VOAMC on the ground that the Appellant had defaulted in deducting tax at source while making payment to VOAMC. This order was upheld by the Commissioner of Income Tax (Appeals) as well as the Income Tax Appellate Tribunal (“ITAT”) and in their opinion tax had to be withheld at the time of making a payment to the non-resident, irrespective of the taxability of non-resident in India. However, the ITAT did allow the deduction to the extent of such portion of the reimbursed amount on which the Appellant had withheld tax. An important fact to note is that, in VOAMC’s assessment, it was held that VOAMC was not liable to tax in India and the tax withheld by the Appellant was refunded to VOAMC.

Ruling of the Court The Court clearly held that obligation to deduct tax under section 195 arises only where the payment is chargeable to tax under the ITA. In other words, a person making a payment to a non-resident is under an obligation to withhold tax under Section 195 only where such amount is chargeable to tax under the provisions of the ITA in the hands of the non-resident. In case a person feels that the tax at source is required to be at a lower rate or that no tax is to be deducted, he is required to file an application before tax officer for obtaining certificates to that effect. The Court also clarified that the order of the AO under this section is tentative in nature. However, the Court did hold that if at the time of assessment of the payer it is found that the payer was required to deduct tax at source pursuant to a direction of the tax officer, he would be treated in default for not deducting tax. But, even in such a case, if it is found during the assessment of the non-resident recipient that the sum is not chargeable to tax, the effect would be that there was no obligation on the payer to deduct tax and thus, he would not be considered to be in default. In the present case, since at the time of this ruling, VOAMC had been found not to be liable to tax, in spite of the direction by AO to deduct tax, the Court held that there was no obligation on the Appellant to do so. It is pertinent to mention the Court’s observations in connection with the Supreme Court ruling in Transmission Corporation Case. The Court pointing out the difference in facts of the aforesaid case, held that therein the Supreme Court was concerned with a situation where the sum was taxable in the hands of the non-resident recipient and the Supreme Court did not deal with a situation where the amount paid was not chargeable to tax at the hands of the non-resident at all. To this extent of this interpretation of the Transmission Corporation Case, the Court specifically differed from the observations made by the Karnataka High Court in Samsung Electronics Co. Ltd. on the same case. The Court also relied on the ruling of the Mumbai ITAT in Mahindra & Mahindra v. DCIT7. Analysis: Section 195 of ITA provides for deduction of tax at source from payments made to a non-resident in the nature of interests or any other sum ‘chargeable’ under the provisions of the ITA. Under section 195(2) it is provided that where the entire sum remitted to a non-resident is not in the nature of income, the payer may apply to the AO for apportionment of the sum chargeable. The controversial interpretation of section 195 as adopted by the Karnataka High Court In Samsung Electronics Co. Ltd., that obligation to withhold remains irrespective of the chargeability, is not a unanimous view of the judiciary and this decision of the Delhi High Court is a clear example of the same. Further, the Authority for Advance Rulings has also, in a recent case of ABB Limited8 noted that in the absence of payment being taxable in India, there is no requirement to withhold tax. In our view, the Court, in this ruling, has rationally evaluated the situation and reached a reasonable conclusion, which in any case, had it not been for the confusion caused by the Karnataka High Court, was the commonly understood interpretation of section 195. This decision is also commendable as far as its interpretation of the Supreme Court decision (Transmission Corporation Case) is concerned. While this ruling definitely sets the right perspective in connection with withholding issue, this issue is far from resolved since the High Court rulings are only binding on the lower courts within its jurisdiction and we may need another Supreme Court ruling to interpret their own ruling. Given that the Samsung case is lined up before the Supreme Court, it may not be too long before that wish too is fulfilled. . 1 ITA No. 2808 to 2810 of 2005 and others 2 For a detailed analysis of this ruling, please refer to our last year’s Tax Hotlines available at http://www.nishithdesai.com/New_Hotline/Tax/Tax%20Hotline_Nov1909.htm and http://www.nishithdesai.com/New_Hotline/Tax/Tax%20Hotline_Dec2809.htm 5 For a detailed analysis of this ruling, please refer to our Tax Hotline dated March 09, 2010 available at http://www.nishithdesai.com/New_Hotline/Tax/Tax%20Hotline_March0910.htm 6 Please click here for a detailed analysis of the Vodafone Saga

You may direct your comments to Ramya Krishnan-AniL +91 900465 0363 |

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||